Canton Man Pleads Guilty in $4M Medicare DME Fraud Scheme

August 25, 2025 | JacobiJournal.com – A Canton man has pleaded guilty in a $4 million Medicare durable medical equipment (DME) fraud scheme involving medically unnecessary orthotic braces and deceptive telemarketing practices. The scheme is part of a broader federal crackdown under the $14.6 billion nationwide Healthcare Fraud Takedown. Federal prosecutors announced that a Massachusetts-based DME provider admitted to defrauding Medicare by billing for orthotic braces that were either not medically necessary or never provided to patients. The defendant, whose identity was released in court filings, used aggressive telemarketing tactics to obtain patient information and physician orders, often without proper medical evaluation. Between 2018 and 2022, the defendant submitted millions in false claims to Medicare for back, knee, wrist, and shoulder braces, resulting in more than $4 million in fraudulent reimbursements. How the DME Fraud Scheme Worked According to the Department of Justice, the Canton man paid overseas and domestic telemarketing companies to cold-call Medicare beneficiaries, offering free or low-cost medical equipment. Once the patient information was obtained, the scheme funneled bogus or forged prescriptions through complicit medical professionals. These orders were then billed to Medicare, even though many patients never received or needed the braces. The DME company also allegedly disguised kickbacks as “marketing fees” and “consulting payments” to conceal the fraud. Federal Crackdown and Takedown Operation This case is part of the U.S. Department of Justice’s 2025 National Healthcare Fraud Enforcement Action, which has resulted in criminal charges against over 200 individuals nationwide. The coordinated action targeted schemes involving telemedicine, DME fraud, pharmacy billing, and opioid distribution — with total intended losses exceeding $14.6 billion. DOJ Statement on the Guilty Plea “Healthcare fraud drains taxpayer dollars, endangers patients, and undermines trust in our medical system,” said Acting U.S. Attorney Joshua S. Levy for the District of Massachusetts. “This guilty plea sends a strong message to those exploiting Medicare: we will hold you accountable.” Sentencing for the defendant is scheduled for later this year. He faces up to 10 years in federal prison, restitution, and forfeiture of assets acquired through fraud. Workers, Patients & Providers: Know Your Rights Medicare beneficiaries are urged to report suspicious calls, billing statements, or unsolicited medical devices. Healthcare providers should maintain strict compliance programs and verify telehealth claims carefully. For full details on this case and other healthcare fraud enforcement actions, visit the U.S. Department of Justice – District of Massachusetts official press release section. FAQs: Canton Man Pleads Guilty Who is the Canton man that pleaded guilty in the Medicare DME fraud case? The man who pleaded guilty was the owner of a DME company that used telemarketing and false medical claims to bill Medicare for unneeded orthotic devices. What was the total amount involved in the DME fraud scheme? The man pleaded guilty to defrauding Medicare of over $4 million through false claims for unnecessary medical equipment. How does this DME fraud case connect to the nationwide healthcare fraud takedown? This DME fraud case is part of the broader $14.6 billion healthcare fraud takedown, which involved hundreds of defendants across the United States. What penalties could he face after pleading guilty? He could face up to 10 years in federal prison, restitution payments, and forfeiture of any assets obtained through the $4 million fraud. Stay ahead of fraud cases, legal updates, and compliance alerts. Subscribe to JacobiJournal.com today for trusted reporting on white-collar crime, healthcare enforcement, and regulatory actions. 🔎 Read More from JacobiJournal.com:

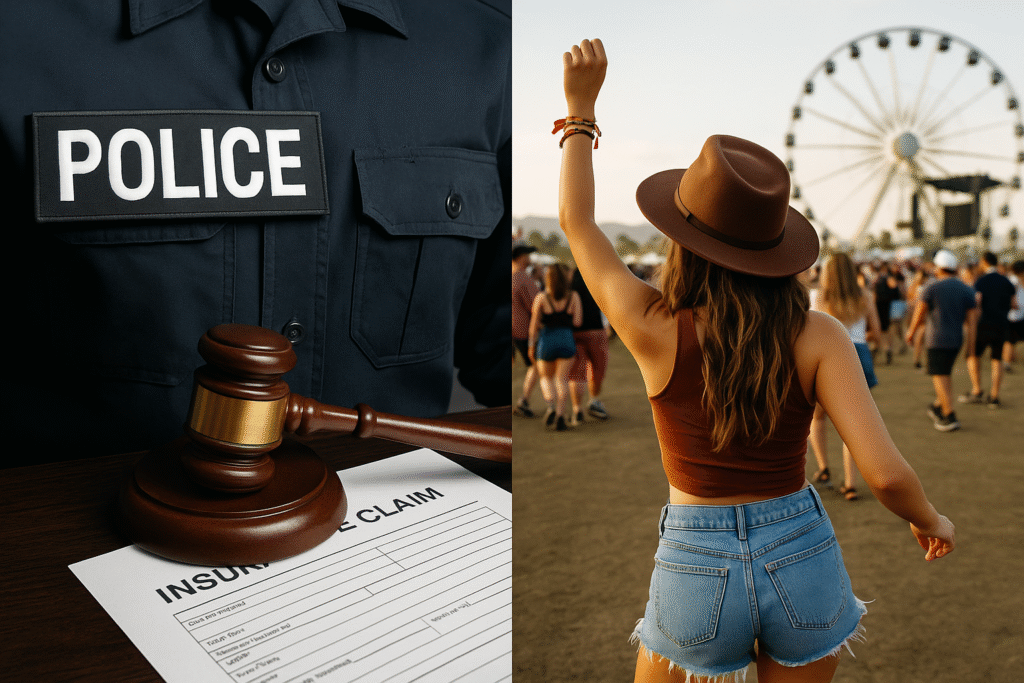

Ex-Westminster Police Officer Charged with Insurance Fraud After Partying on Disability Leave

Former Westminster police officer charged with workers’ compensation fraud after being spotted partying and traveling during medical leave. Tracey Leong reports for NBC4 News at 11 p.m., May 20, 2025. Credit: NBC Los Angeles — https://www.nbclosangeles.com/ May 21, 2025 | JacobiJournal.com – A former Westminster police officer faces felony charges for allegedly committing insurance fraud and workers’ compensation fraud during her disability leave, the Orange County District Attorney’s Office announced. Nicole Brown, 39, from Riverside, faces nine felony counts for making false statements to receive compensation. She also faces six counts of fraudulent insurance claims. Prosecutors added a sentencing enhancement for aggravated white-collar crime involving over $100,000. Her stepfather, attorney Peter Gregory Schuman, 57, from Buena Park, also faces felony charges for filing fraudulent insurance claims and conspiring to commit illegal acts. Injury and Disability Insurance Fraud Allegations Brown injured her forehead while arresting a suspect in March 2022. An emergency room doctor treated her and cleared her to return to work. However, she later claimed a severe concussion and went on temporary disability leave, which is now at the center of the insurance fraud investigation initiated by the Orange County District Attorney’s Office. Evidence of Contradictory Activities During this time, Brown reportedly attended the Stagecoach Music Festival in April 2023 and was seen traveling and partying. Witnesses reported her dancing and drinking, contradicting her claims of severe symptoms. Investigators also found that Brown took part in two 5K races, snowboarded, skied, attended several soccer conferences, went to baseball games, played golf, and visited Disneyland. She also enrolled in online courses, despite complaining about screen sensitivity. Defense Statement Brown’s lawyer, Brian Gurwitz, said, “Ms. Brown suffered a debilitating head injury while on duty. She plans to vigorously challenge these allegations.” Legal Consequences and Next Steps The charges highlight increased scrutiny of workers’ compensation claims when claimants’ activities conflict with their reported injuries. Brown and Schuman face serious legal consequences if convicted. Stay updated with local crime and legal news from Orange County. FAQs: About Insurance Fraud and Disability Leave Abuse What qualifies as insurance fraud during disability leave? Insurance fraud occurs when an individual knowingly provides false or misleading information to receive disability benefits. In law enforcement or public service, this often includes exaggerating injuries or continuing to claim benefits after recovery. How do investigators detect insurance fraud in disability leave cases? Insurance fraud investigators often rely on surveillance footage, social media activity, medical record reviews, and witness testimony to identify discrepancies between a claimant’s reported injuries and actual behavior. In disability fraud cases, evidence of physical activity—like traveling or partying—while on leave can trigger prosecution. What are the legal consequences of committing insurance fraud while on leave? Penalties for insurance fraud may include felony charges, restitution orders, termination of employment, and loss of future benefits. In California, convicted individuals may also face imprisonment, fines, and professional disqualification. Subscribe to JacobiJournal.com for trusted updates on law enforcement misconduct, insurance fraud cases, and public integrity prosecutions across the U.S. 🔎 Read More from JacobiJournal.com: