California DME Provider Sentenced in $61 Million Medicare Fraud Case

July 8, 2025 | JacobiJournal.com – California Medicare fraud continues to strain the healthcare system, as federal authorities announced the sentencing of a California durable medical equipment (DME) provider for their role in a $61 million Medicare fraud scheme. This case marks one of the largest DME fraud prosecutions in the state, illustrating the persistent abuse within Medicare billing practices. The convicted owner, whose name remains under protective order due to ongoing investigations, operated several DME companies across Southern California. They systematically submitted fraudulent claims for medical equipment that was neither prescribed by physicians nor delivered to patients. Scheme Details: How the $61M Fraud Was Perpetrated According to court records from the Department of Justice (DOJ), the provider exploited Medicare billing codes, inflating charges for expensive orthotic braces and mobility devices. In many instances, patient information was obtained without consent through deceptive marketing tactics and identity theft. Additionally, the provider collaborated with complicit healthcare professionals who signed off on false prescriptions in exchange for kickbacks. This illegal network enabled the provider to claim reimbursements on a massive scale, ultimately defrauding Medicare out of $61 million between 2017 and 2022. Broader Implications for Medicare Integrity California Medicare fraud schemes like this erode the public trust in healthcare systems and divert resources from genuine patients in need. Fraudulent billing not only strains federal budgets but also compromises the delivery of appropriate patient care. Healthcare fraud experts warn that the DME sector remains a high-risk area for exploitation due to its reliance on third-party suppliers and minimal direct patient oversight. Without enhanced auditing systems, the Medicare program continues to face vulnerabilities that bad actors can exploit. Sentencing and Enforcement Actions The court sentenced the provider to 12 years in federal prison, imposed restitution orders, and initiated asset forfeiture proceedings to recover stolen funds. Authorities emphasized that this case serves as a deterrent for other providers who may consider engaging in Medicare fraud. Assistant Attorney General Kenneth A. Polite, Jr. of the DOJ’s Criminal Division stated, “Healthcare fraud at this scale harms every taxpayer. This sentencing reaffirms our commitment to pursuing justice aggressively in California and beyond.” For details on the DOJ’s crackdown on DME fraud, see the official DOJ press release. About California Medicare Fraud What is California Medicare fraud involving DME providers? California Medicare fraud involving DME providers occurs when companies bill Medicare for durable medical equipment that was never prescribed, needed, or delivered to patients. This fraudulent activity results in significant financial loss for the Medicare system. How does Medicare fraud impact California taxpayers? Medicare fraud increases healthcare costs for everyone, drains public funds meant for legitimate care, and undermines trust in the healthcare system. In California, large fraud cases can divert millions from essential services. How is the government combating California Medicare fraud? The Department of Justice, along with the Office of Inspector General (OIG) and the Centers for Medicare & Medicaid Services (CMS), employs data analytics, whistleblower programs, and enforcement task forces to detect and prosecute California Medicare fraud cases effectively. What are the penalties for committing California Medicare fraud involving DME providers? Individuals convicted of California Medicare fraud, particularly involving durable medical equipment (DME), face severe penalties including lengthy federal prison sentences, hefty fines, restitution payments, and asset forfeiture. Convictions also result in permanent exclusion from participating in federal healthcare programs like Medicare and Medicaid. To stay updated on critical healthcare fraud developments like this California Medicare fraud case, subscribe to JacobiJournal.com for the latest investigations and policy updates. 🔎 Read More from JacobiJournal.com:

National Health Care Fraud Takedown: California Defendants Charged in $14.6B Scam

July 4, 2025 | JacobiJournal.com – Federal authorities have charged 324 defendants in the 2025 National Health Care Fraud Takedown, exposing schemes worth over $14.6 billion. Among them, California healthcare fraud cases stood out, particularly in telemedicine, durable medical equipment (DME), lab testing, and opioid-related crimes. The Department of Justice confirmed that in the Northern District of California, five defendants face indictments for orchestrating Medicare fraud and illegal drug diversion schemes. These charges reflect California’s significant role in nationwide healthcare fraud trends, as the state remains a key focus for federal investigators due to its large healthcare market and history of complex fraud cases. According to the Office of Inspector General (OIG), these California-based schemes exploited vulnerable patient populations, fabricated billing for unnecessary or non-existent services, and contributed to the growing opioid crisis through illegal prescriptions. Authorities noted that advanced data analytics and inter-agency collaboration were pivotal in identifying these fraudulent networks. Federal prosecutors have emphasized that California healthcare fraud is not only a legal issue but a public health concern, draining critical resources from Medicare and Medicaid programs. As enforcement continues, healthcare providers and entities in the state are urged to strengthen compliance measures to avoid legal repercussions and safeguard public trust. Northern California’s Key Medicare Fraud Cases One notable defendant, Vincent Thayer of San Jose, is accused of submitting $68 million in fraudulent COVID-19 testing claims to Medicare, Medicaid, and the HRSA COVID-19 Uninsured Program. Authorities allege that Thayer exploited pandemic-era funding mechanisms, filing claims for tests that were either never performed or were medically unnecessary. This significant case underscores how California healthcare fraud schemes adapted quickly to capitalize on emergency federal funding intended for public health support during the pandemic. Another case involves Sevendik Huseynov of Sunnyvale, who is charged with using stolen identities to fraudulently bill Medicare Advantage for unnecessary durable medical equipment (DME). By manipulating patient information and fabricating needs for equipment like braces and orthotics, Huseynov allegedly siphoned millions from federal healthcare programs. These California healthcare fraud cases reveal how deeply fraudsters have infiltrated not only pandemic relief programs but also routine healthcare billing systems. The scale of deception reflects broader vulnerabilities in healthcare oversight, where swift adaptations by criminal networks can outpace regulatory safeguards. Federal officials stress that these prosecutions are part of an intensified crackdown aimed at deterring similar frauds and protecting the integrity of healthcare funding in California and nationwide. The Department of Justice, alongside the Department of Health and Human Services Office of Inspector General, continues to pursue those who exploit public health crises for personal gain. DOJ’s Data-Driven Fight Against California Healthcare Fraud Following this sweep, the DOJ’s Health Care Fraud Data Fusion Center is set to intensify efforts using AI and advanced data analytics to identify fraud patterns, particularly within California’s complex healthcare landscape. The state’s diverse and extensive healthcare infrastructure—spanning large hospital systems, telemedicine providers, and specialized care facilities—creates multiple entry points for bad actors. By leveraging predictive analytics, the DOJ aims to detect emerging California healthcare fraud trends before they escalate into billion-dollar losses. These technologies enable authorities to cross-reference billing anomalies, patient data, and provider networks in real-time, exposing schemes that would traditionally remain hidden for years. Officials emphasize that California’s high volume of healthcare transactions, combined with its leadership in digital health innovation, makes it both a target and a testbed for fraud detection initiatives. The ongoing collaboration between the DOJ, HHS Office of Inspector General, and California state agencies ensures that data-driven enforcement is tailored to the unique challenges posed by the state’s healthcare sector. Read the DOJ’s official press release on the takedown here. FAQs: About California Healthcare Fraud Takedown What is the National Health Care Fraud Takedown? The National Health Care Fraud Takedown is a coordinated federal effort by the DOJ and HHS to target large-scale healthcare fraud across the U.S., including cases of Medicare fraud, telemedicine scams, and drug diversion. How is California involved in healthcare fraud cases? California healthcare fraud cases often involve telemedicine billing schemes, DME fraud, and illegal drug diversion, with defendants exploiting federal healthcare programs like Medicare and Medicaid. What penalties do defendants face in California healthcare fraud cases? Defendants charged in California healthcare fraud cases face severe penalties, including significant prison time, hefty fines, and asset forfeiture if convicted of fraud, conspiracy, and related offenses. Stay Informed on Healthcare Fraud Enforcement. Subscribe to JacobiJournal.com for real-time updates on fraud investigations and healthcare compliance enforcement. 🔎 Read More from JacobiJournal.com:

OJ Indicts 49 in $1.17 Billion Telehealth Genetic Testing Fraud

July 2, 2025 | JacobiJournal.com – The Department of Justice (DOJ) has announced the indictment of 49 individuals connected to a massive telehealth genetic testing fraud scheme that defrauded Medicare of approximately $1.17 billion. This national enforcement action marks one of the most significant takedowns targeting the intersection of telemedicine and genetic testing abuse. National Crackdown on Telemedicine Scams Federal prosecutors revealed that defendants operated fraudulent telehealth consultations to justify unnecessary genetic testing and medical equipment. These fake medical services led to thousands of false Medicare claims for tests that patients did not need, did not request, or never received. Investigators discovered that telemedicine companies collaborated with laboratories and marketing firms to orchestrate the scam, exploiting both patients and Medicare’s billing systems. The DOJ emphasized that while telehealth offers legitimate benefits, fraudsters have weaponized the convenience of virtual care to conceal large-scale fraud. Financial and Ethical Impact of Telehealth Genetic Testing Fraud Authorities stated that this scheme drained over a billion dollars from Medicare, ultimately burdening taxpayers and undermining trust in remote healthcare services. Fraudulent genetic testing not only results in financial losses but also exposes patients to unnecessary medical procedures and the risk of compromised personal health data. DOJ Reinforces Commitment to Healthcare Integrity The DOJ reiterated its commitment to pursuing healthcare fraud aggressively, especially as telemedicine remains a growing field. Officials encouraged healthcare providers to strengthen compliance efforts and urged the public to remain vigilant against suspicious medical services. For additional information on how to recognize and report Medicare fraud, visit the Centers for Medicare & Medicaid Services (CMS) official resource page. What’s Next for Enforcement The DOJ hinted that further investigations are underway, with more arrests expected in related telehealth and genetic testing schemes. Federal prosecutors have emphasized that this is only the beginning of a larger nationwide effort to dismantle complex fraud networks exploiting Medicare through telemedicine. As telehealth genetic testing fraud continues to evolve, authorities are enhancing interagency collaboration between the DOJ, FBI, and the Department of Health and Human Services to track and intercept these fraudulent operations. Additionally, the DOJ plans to leverage advanced data analytics and whistleblower tips to identify hidden connections between healthcare providers, laboratories, and telehealth platforms that may be facilitating or concealing fraud. This July enforcement wave reflects a broader strategy to safeguard public healthcare funds, strengthen Medicare integrity, and restore confidence in digital health services by ensuring that telehealth remains a legitimate and safe avenue for patient care. FAQ: Understanding Telehealth Genetic Testing Fraud What is telehealth genetic testing fraud? Telehealth genetic testing fraud involves scammers using virtual healthcare platforms to order unnecessary or fake genetic tests. Fraudsters often collaborate with labs and marketing firms to bill Medicare for services that were never needed or provided. How can patients avoid falling victim to telehealth genetic testing fraud? Patients should consult their primary care physician before agreeing to any genetic tests offered through telehealth. They should also verify that the provider is legitimate and be cautious of unsolicited offers for medical testing. How do authorities detect and investigate telehealth genetic testing fraud? Authorities like the DOJ and CMS use data analytics to identify abnormal billing patterns and networks of providers submitting excessive claims for genetic testing. Investigations often trace financial transactions to uncover fraudulent schemes. Where can I report suspected telehealth genetic testing fraud? You can report suspected telehealth genetic testing fraud directly to Medicare here or contact the Office of Inspector General (OIG) fraud hotline. Stay informed on telehealth genetic testing fraud cases and healthcare enforcement actions. Subscribe to JacobiJournal.com for weekly updates on fraud prosecutions, regulatory crackdowns, and compliance news. 🔎 Read More from JacobiJournal.com:

Home Health Agency Owner Convicted for $400K in Medicare Fraud via Falsified Records

June 30, 2025 | JacobiJournal.com – A home health agency owner has been convicted in a $400,000 Medicare fraud scheme that involved falsified documentation to claim services never provided. This case adds to the growing list of healthcare fraud prosecutions, particularly in home-based care, a sector increasingly scrutinized by federal authorities. Fabricated Records, Real Consequences in Medicare Fraud The owner directed staff to forge patient records, including visit notes and certifications, to create the appearance of legitimate medical services. These fake claims were submitted to Medicare, resulting in substantial reimbursement for treatments that either never occurred or were medically unnecessary. Investigators found a pattern of deception dating back several years. Systemic Oversight Failure in Medicare Fraud This conviction underscores how documentation abuse remains a persistent vulnerability in the Medicare system. Home health agencies, while vital for aging populations, continue to face enforcement due to weak internal controls and high reimbursement incentives. Prosecutors noted that the scheme not only defrauded taxpayers but also undermined trust in care delivery. A Signal to the Industry Federal officials have reiterated that healthcare fraud—especially involving home health services—will remain a high-priority enforcement area. With billions allocated annually to Medicare, oversight agencies are ramping up audits and encouraging whistleblowers to report suspicious billing practices. Lessons from the Case Industry experts recommend stronger compliance protocols, regular chart audits, and better staff training to prevent similar schemes. Patients and families are also urged to stay informed about services billed under their names to spot potential abuse early. As federal crackdowns continue, the healthcare sector is reminded that cutting corners not only risks legal penalties—it puts patients and public trust on the line. For more information on Medicare fraud prevention, visit the official Medicare.gov Fraud Prevention page. FAQs: What is Home Health Medicare Fraud? Home Health Medicare Fraud involves false claims submitted by home health agencies for services that were never provided or medically unnecessary. This type of fraud undermines the integrity of Medicare funding and patient care. How can patients detect Home Health Medicare Fraud? Patients can review their Medicare statements regularly, ensuring all billed services were actually received. Discrepancies should be reported to Medicare immediately to prevent further fraud. What are the penalties for Home Health Medicare Fraud? Convictions for Home Health Medicare Fraud can lead to significant fines, restitution, and prison sentences, as seen in this case where the agency owner was convicted of defrauding Medicare of $400,000. Stay informed on healthcare fraud cases and compliance strategies. Subscribe to JacobiJournal.com for weekly updates on enforcement trends and industry risks. 🔎 Read More from JacobiJournal.com:

Telehealth CEO Convicted in $1B Medicare Fraud Case

June 27, 2025 | JacobiJournal.com – Telehealth Medicare fraud has taken center stage as the CEO of a telehealth software firm has been convicted in a billion-dollar healthcare fraud case. The conviction spotlights the dark side of digital medicine and the vulnerabilities within remote healthcare services. Prosecutors revealed that the executive orchestrated an expansive scheme that exploited Medicare billing through fraudulent prescriptions and medical orders—all disguised as legitimate virtual care. This case underscores the urgent need for stronger oversight in telehealth platforms to prevent further instances of telehealth Medicare fraud that jeopardize both patients and public funds. How the Telehealth Medicare Fraud Scheme Operated According to court documents and trial testimony, the company used its digital platform to generate false doctors’ orders and prescriptions. These included durable medical equipment and compound medications. The claims were submitted to Medicare and other federal programs as if they followed legitimate telehealth consultations, but they were part of an orchestrated telehealth Medicare fraud scheme designed to exploit billing loopholes. In truth, many patients had little to no interaction with a physician. In some cases, they were completely unaware that claims had been made in their name. This deception not only defrauded federal healthcare programs but also compromised patient data and trust, underscoring the broader risks that telehealth Medicare fraud poses to both individuals and the healthcare system at large. Targeting the Elderly The fraud relied on a nationwide network of call centers, marketers, and medical professionals who approved orders without proper review. Investigators found the scheme focused heavily on elderly Medicare beneficiaries. Deceptive tactics were used to enroll them in unnecessary treatment plans and billing cycles. As a result, Medicare paid out hundreds of millions of dollars before the fraud was detected. Uncovering the Scheme Authorities allege that the company submitted thousands of bogus claims for medical devices and prescriptions, many of which patients never requested or received. These claims appeared legitimate on paper, backed by fake telehealth consults and forged doctor approvals. Investigators say the scam targeted elderly beneficiaries, often without their knowledge. Why Telehealth Was Vulnerable The case raises serious concerns about how telehealth platforms, while convenient, can be misused. Rapid digital interactions made it easier for fraudulent claims to slip through, with billing systems ill-equipped to catch falsified consults in real time. This vulnerability created a perfect environment for telehealth Medicare fraud to thrive, as the absence of in-person verification allowed unscrupulous providers to manipulate the system without immediate detection. Moreover, the rapid expansion of telehealth during the pandemic outpaced the development of fraud prevention measures. As a result, many healthcare platforms lacked the robust compliance infrastructure necessary to identify patterns indicative of telehealth Medicare fraud. This gap in oversight is now prompting federal agencies and healthcare providers to reevaluate digital healthcare protocols to ensure stricter safeguards against such large-scale scams. A Warning to the Industry The executive’s conviction marks one of the largest healthcare fraud penalties linked to telehealth. While the technology itself isn’t to blame, the case highlights a deeper issue. Telehealth needs tighter compliance, stronger verification, and better oversight. This is especially urgent given the surge in telehealth Medicare fraud, which has exposed weaknesses in virtual care systems that were never designed to handle the scale of Medicare billing they now face. Industry leaders are being urged to collaborate with regulatory agencies to develop standardized protocols for telehealth services, including more stringent patient authentication and provider credentialing processes. Without proactive measures, the risk of telehealth Medicare fraud remains high, potentially undermining public trust in digital healthcare innovations. What It Means for Healthcare Providers As the use of telemedicine expands, healthcare professionals and vendors must implement stronger fraud controls. This case serves as a critical reminder: efficiency should never override ethical standards. Looking Ahead With sentencing set for later this year, federal agencies are signaling more scrutiny for telehealth firms. Compliance audits, provider vetting, and real-time billing review systems may become standard as regulators aim to prevent similar fraud on this scale. Digital care is here to stay—but integrity must stay with it. For official updates on Medicare fraud enforcement, visit the U.S. Department of Justice’s healthcare fraud page. FAQs About Fort Bend Hospice Healthcare Fraud What is the Fort Bend hospice healthcare fraud case about? The case involves hospice owners in Fort Bend County indicted for fraudulently enrolling non-terminally ill patients into hospice care, forging medical records, and submitting false claims totaling $87 million to Medicare and Medicaid. How does hospice fraud impact patients? Patients may be misclassified as terminally ill without their knowledge, limiting access to curative treatments and appropriate medical care. This can compromise patient safety and care quality. What penalties do the defendants face in the Fort Bend hospice healthcare fraud case? If convicted, the indicted hospice owners could face decades in federal prison, significant fines, and asset forfeiture under healthcare fraud and wire fraud statutes. Stay ahead of healthcare fraud developments. Subscribe to JacobiJournal.com for the latest insights on telehealth fraud enforcement and policy updates. 🔎 Read More from JacobiJournal.com:

DOJ Indicts Hospice Owners in Fort Bend for Massive $87M Healthcare Fraud

June 25, 2025 | JacobiJournal.com – Fort Bend hospice healthcare fraud remains a growing concern as federal programs face ongoing exploitation. Healthcare fraud continues to plague these systems, with the Department of Justice indicting two hospice owners in Fort Bend County for their alleged role in a $87 million Medicare and Medicaid scheme. The charges, announced in June, involve fraudulent billing practices and falsified patient records that exploited end-of-life care services for financial gain. Fraudulent Admissions and Falsified Records According to the indictment, the defendants enrolled patients who were not terminally ill into hospice programs, contributing to the broader issue of Fort Bend hospice healthcare fraud. They allegedly forged physician documentation and backdated certifications to make those patients appear eligible for end-of-life care. Furthermore, prosecutors claim the group paid kickbacks to doctors and hospital employees to secure fraudulent referrals, deepening the extent of the healthcare fraud scheme. Oversight Failures and Financial Damage The scheme, which ran from 2019 to 2025, went largely undetected until federal audits in 2022 raised concerns about the ongoing Fort Bend hospice healthcare fraud. Despite these early warnings, the fraudulent billing reportedly continued, highlighting significant gaps in regulatory oversight and enforcement mechanisms. Officials state that over $110 million in claims were submitted, with approximately $87 million reimbursed by Medicare and Medicaid. This lapse in oversight not only enabled the fraud to persist but also exposed weaknesses in the monitoring systems meant to safeguard public healthcare funds. Regulatory agencies have since emphasized the importance of more frequent audits, enhanced data analysis, and cross-agency cooperation to identify and stop such healthcare fraud schemes earlier in the process. Patient Harm and Legal Ramifications Many patients enrolled in hospice were unaware of their change in care status, which could have delayed or denied them appropriate treatment. The legal charges include conspiracy to commit healthcare fraud and wire fraud. If convicted, the defendants face decades in prison and millions in asset forfeitures. A Warning for Medical-Legal Stakeholders This case underscores the urgent need for stronger compliance systems in hospice and palliative care. Legal teams, regulators, and healthcare providers must implement better audit protocols and patient verification processes to prevent similar abuses in the future. As healthcare fraud becomes more complex, enforcement and ethical oversight remain critical pillars of patient safety and public trust. Learn more about healthcare fraud prevention efforts from the U.S. Department of Health & Human Services OIG. FAQs About Fort Bend Hospice Healthcare Fraud What is the Fort Bend hospice healthcare fraud case about? The case involves hospice owners in Fort Bend County indicted for fraudulently enrolling non-terminally ill patients into hospice care, forging medical records, and submitting false claims totaling $87 million to Medicare and Medicaid. How does hospice fraud impact patients? Patients may be misclassified as terminally ill without their knowledge, limiting access to curative treatments and appropriate medical care. This can compromise patient safety and care quality. What penalties do the defendants face in the Fort Bend hospice healthcare fraud case? If convicted, the indicted hospice owners could face decades in federal prison, significant fines, and asset forfeiture under healthcare fraud and wire fraud statutes. Stay updated on healthcare fraud enforcement and legal actions. Subscribe to JacobiJournal.com for weekly insights into fraud investigations, regulatory updates, and policy developments. 🔎 Read More from JacobiJournal.com:

Social Security Insider Fraud: A Breach of Public Trust

June 23, 2025 | JacobiJournal.com – Social Security insider fraud has once again exposed vulnerabilities in a system designed to serve the public. In a recent case, a former employee of the Social Security Administration (SSA) pleaded guilty to orchestrating a multimillion-dollar fraud scheme. This case shines a light on significant failures in internal oversight and highlights the persistent threat posed by insider abuse within public agencies. How Internal Controls Failed Despite the presence of regulatory protocols, the scheme went undetected for an extended period. The employee exploited gaps in internal processes, using privileged access to siphon funds meant for legitimate beneficiaries. This incident illustrates how outdated security measures and insufficient oversight create opportunities for insider fraud to flourish. Moreover, this case highlights the critical need for agencies like SSA to continually assess and update their monitoring systems. Fraud of this scale does not happen in a vacuum—it thrives in environments where red flags are ignored or go unseen due to lax internal audits and infrequent policy reviews. Strategies to Prevent Insider Fraud Government agencies must act decisively to strengthen their defenses. First, they should implement advanced fraud detection software capable of flagging suspicious activity in real time. Routine internal audits and cross-departmental reviews can also serve as important checks on employee behavior. In addition, investing in employee ethics training and creating clear channels for whistleblower reports encourages a culture of transparency. Supporting and protecting whistleblowers could prevent long-term damage by identifying misconduct early. For official information on the SSA’s integrity efforts, visit the Social Security Administration’s Office of Inspector General. Restoring Trust in Public Institutions When insider fraud occurs within critical agencies like Social Security, public trust takes a hit. To rebuild confidence, institutions must not only hold wrongdoers accountable but also commit to systemic reform. Updating internal protocols, enforcing ethical standards, and enhancing transparency are key steps to ensuring such abuse does not happen again. In safeguarding taxpayer-funded programs, vigilance must be a permanent priority. FAQs About Social Security Insider Fraud What is Social Security insider fraud? Social Security insider fraud occurs when employees within the SSA abuse their access to divert funds illegally, often exploiting weak internal controls to avoid detection. How can the Social Security Administration prevent insider fraud? The SSA can prevent insider fraud by implementing advanced fraud detection software, conducting routine audits, providing employee ethics training, and establishing secure whistleblower channels. What are the consequences of Social Security insider fraud? Social Security insider fraud leads to financial losses for taxpayers, damages public trust in government agencies, and can result in criminal charges and imprisonment for the perpetrators. Stay informed on fraud cases and government enforcement updates. Subscribe to JacobiJournal.com for in-depth insights on public sector fraud risks and prevention strategies. 🔎 Read More from JacobiJournal.com:

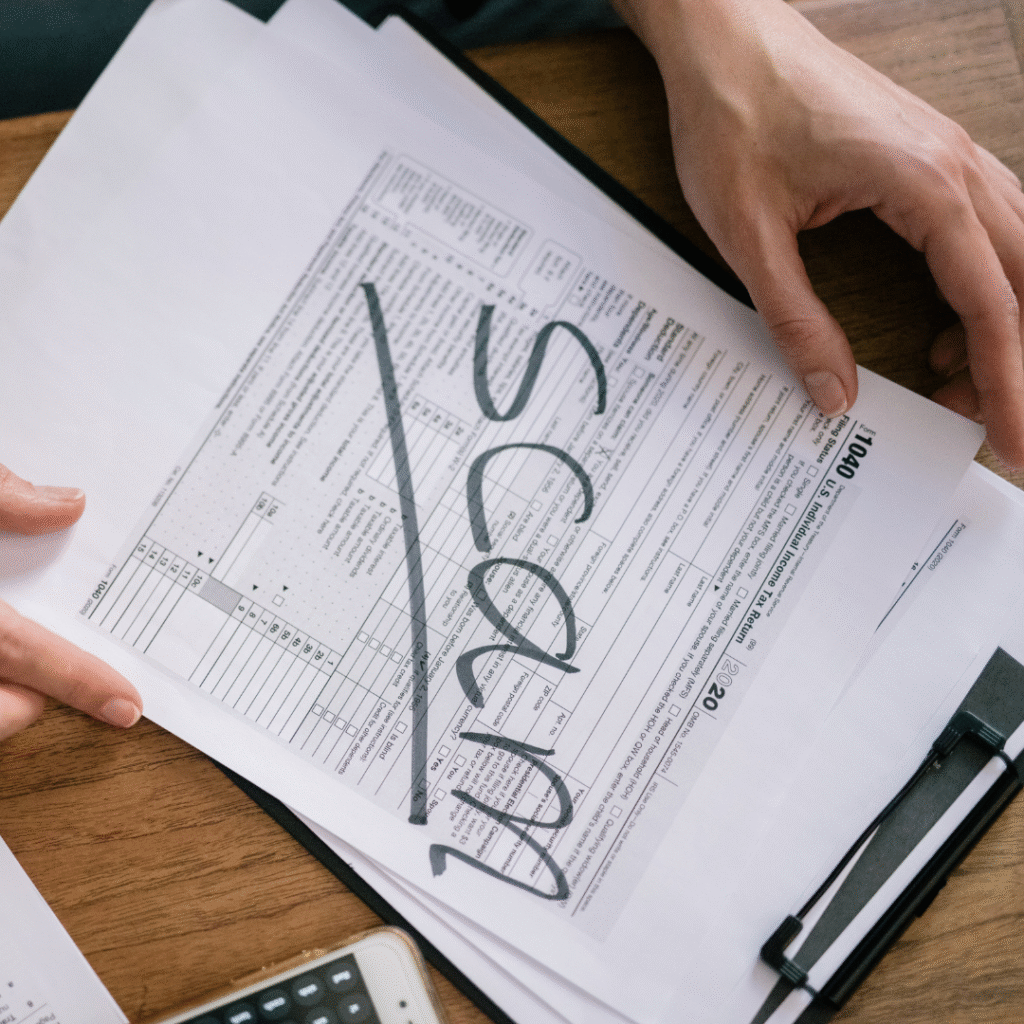

Financial Fraud’s Expanding Reach: One in Five Americans Affected

June 20, 2025 | JacobiJournal.com – Financial fraud is now a national epidemic, with one in five Americans falling victim to scams ranging from phishing schemes to identity theft. As fraud tactics become more advanced, individuals of all ages and backgrounds face increasing risk. Recent reports reveal that financial fraud isn’t limited to one sector or demographic. Instead, it’s spreading across industries—targeting consumers through email, phone calls, social media, and even fake job listings. This widespread vulnerability underscores a serious need for stronger public awareness and systemic safeguards. How Scams Are Evolving Fraudsters now use more sophisticated techniques to deceive their targets. For instance, some impersonate trusted institutions, such as banks or government agencies. Others manipulate social platforms to push fraudulent investment opportunities or “get-rich-quick” schemes. The rise of AI-generated content and deepfakes adds another layer of complexity, making it harder to tell real from fake. Who’s at Risk While older adults were once prime targets, younger generations are increasingly affected. Millennials and Gen Z, often more active online, are falling victim to digital scams at alarming rates. Additionally, minority communities and low-income groups tend to be disproportionately impacted, often due to limited access to fraud education and resources. Why It Matters Now The financial and emotional toll of fraud can be devastating. Victims not only lose money but also face damaged credit, legal issues, and lasting psychological effects. Moreover, widespread fraud erodes public trust in financial systems, making the need for change even more urgent. What Can Be Done To combat this growing threat, experts urge stronger fraud detection tools, educational initiatives, and more aggressive law enforcement action. Staying informed is key—consumers must remain alert, verify sources, and report suspicious activity immediately. For more resources on preventing financial fraud, visit the Federal Trade Commission (FTC) fraud resources. FAQs About Financial Fraud What is financial fraud and how does it impact Americans? Financial fraud refers to deceptive schemes like identity theft, phishing, and investment scams that result in financial loss. In 2025, one in five Americans have reported being targeted or affected by such scams. How can I protect myself from financial fraud? To avoid financial fraud, always verify requests for personal information, use strong passwords, enable two-factor authentication, and monitor bank statements regularly. Reporting suspicious activity to authorities helps curb further exploitation. Are certain age groups more vulnerable to financial fraud? While older adults were previously more targeted, younger people, including Millennials and Gen Z, now face increasing exposure to financial fraud, particularly through social media scams and digital phishing tactics. Stay informed and safeguard your finances. Subscribe to JacobiJournal.com for weekly insights on fraud trends, prevention tips, and regulatory updates. 🔎 Read More from JacobiJournal.com:

Genetic Testing Scams: The New Face of Medicare Fraud

June 18, 2025 | JacobiJournal.com – Genetic testing scams are quickly becoming a major form of Medicare fraud, targeting seniors with misleading offers and unauthorized billing schemes. These scams usually begin with a cold call, a booth at a senior center, or even a misleading TV ad claiming to offer free DNA testing for cancer or other conditions. Once a patient provides their Medicare number, scammers bill the government for unnecessary or completely fake tests—costing taxpayers millions. Although these scams promise insight into personal health, they rarely provide any medical value. Instead, the goal is to exploit Medicare’s coverage of genetic testing. A Growing Threat to Seniors and Taxpayers The appeal of genetic insights makes this scam effective, particularly among vulnerable senior populations who are more likely to trust medical professionals or health-related offers. Fraudsters often employ aggressive marketing tactics and fake affiliations with Medicare or healthcare providers to establish trust and gain access to sensitive private information. Furthermore, these schemes often involve third-party labs and marketers who split profits from fraudulent claims, making detection even more challenging. This multi-layered setup allows scam operations to avoid early scrutiny while maximizing profit. Protecting the Public and Medicare Government agencies, including the Office of Inspector General and CMS, have issued warnings and are actively investigating such schemes. Still, public awareness is key. Patients should never share Medicare information with unfamiliar sources or agree to free tests without consulting their doctor. Ultimately, understanding how genetic testing scams work is the first step in stopping them. Clear regulations, routine audits, and public education will be crucial in protecting both patient trust and public funds. For more official information on Medicare-related scams, visit the Office of Inspector General (OIG) fraud alerts. FAQs: About Genetic Testing Scams How do genetic testing scams target Medicare patients? Genetic testing scams often begin with unsolicited calls, senior center booths, or deceptive ads offering free DNA tests. Scammers collect Medicare numbers to bill for unnecessary or fake tests, exploiting both seniors and the Medicare system. What risks do seniors face from genetic testing scams? Victims of genetic testing scams risk identity theft, compromised medical data, and contributing to Medicare fraud unknowingly. These scams often leave patients without any valuable health insights despite claims. How can Medicare beneficiaries avoid genetic testing scams? To avoid genetic testing scams, seniors should only undergo genetic testing recommended by their personal doctor. Medicare numbers should never be shared with unsolicited callers, marketers, or unfamiliar medical providers. Stay protected against healthcare fraud. Subscribe to JacobiJournal.com for ongoing updates on Medicare scams, fraud enforcement, and patient safety insights. 🔎 Read More from JacobiJournal.com:

$1 Million COVID Relief Scam Exposed: NSW Authorities Arrest Four in Fraud Crackdown

June 16, 2025 | JacobiJournal.com – Authorities in New South Wales have uncovered a major COVID relief scam, arresting four men allegedly involved in defrauding over $1 million through fraudulent government grant applications. The arrests follow a months-long investigation into suspicious pandemic-related financial claims. According to investigators, the group submitted dozens of falsified applications for business support grants and COVID relief payments between 2020 and 2022. These applications reportedly included fake documents, inflated revenue losses, and fictitious business identities designed to deceive state funding programs created to support legitimate businesses during lockdowns. Coordinated Fraud Operation Police believe the syndicate operated as a coordinated unit, using stolen or fabricated identities and manipulating digital records to pass multiple application screenings. Moreover, the group allegedly cycled the stolen funds through a network of personal and shell accounts to avoid detection. The investigation intensified when financial discrepancies and duplicate applications triggered alerts within the state’s internal auditing systems. As a result, authorities launched targeted raids across Sydney and its suburbs, leading to the seizure of electronic devices, fake documents, and large amounts of cash. Government Response and Warning Officials have emphasized that this case demonstrates the vulnerability of emergency funding programs to exploitation when oversight is insufficient. A government spokesperson stressed the importance of maintaining robust fraud detection protocols for any future crisis-related assistance programs. “This kind of fraud not only undermines public trust but also deprives those truly in need,” said one official during a press briefing. Why This Case Matters While emergency grants are essential during national crises, this case highlights the urgent need for secure systems that can flag suspicious behavior early. With the global economy still recovering from the pandemic, fraud prevention remains a top priority for policymakers, regulators, and auditors alike. Moving forward, enhanced background checks, cross-agency data sharing, and fraud education campaigns are expected to play a bigger role in safeguarding taxpayer money. For further updates on fraud prevention in Australia, visit the Australian Competition & Consumer Commission (ACCC). FAQs: About the COVID Relief Scam How did the COVID relief scam in NSW operate? The COVID relief scam involved the submission of falsified business support grant applications using fake documents, inflated revenue losses, and stolen identities. This coordinated effort deceived NSW government programs designed to aid businesses during pandemic lockdowns. What penalties do suspects in a COVID relief scam face in Australia? Individuals involved in a COVID relief scam in Australia can face serious charges, including fraud, identity theft, and money laundering. Convictions may lead to lengthy prison sentences, asset seizures, and financial penalties. How can future COVID relief scams be prevented? Preventing COVID relief scams requires stronger oversight, enhanced fraud detection tools, cross-agency data sharing, and public awareness campaigns. These measures help ensure government funds reach legitimate applicants during crises. Stay informed on financial fraud, regulatory crackdowns, and government aid protections. Subscribe to JacobiJournal.com for expert coverage on emerging fraud cases and enforcement trends. 🔎 Read More from JacobiJournal.com: