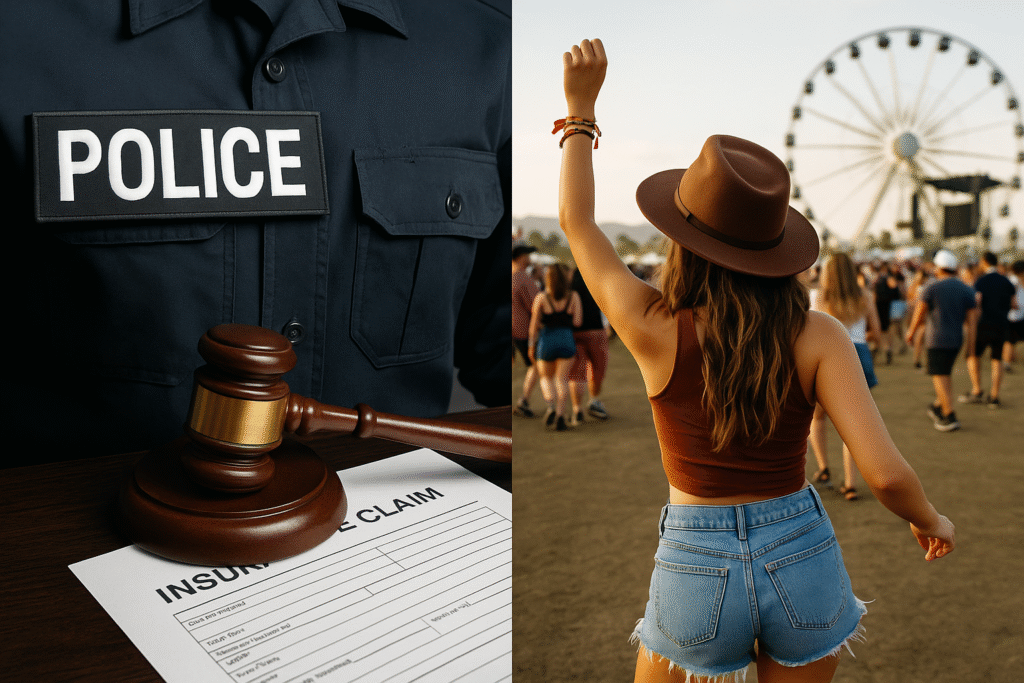

Ex-Westminster Police Officer Charged with Insurance Fraud After Partying on Disability Leave

Former Westminster police officer charged with workers’ compensation fraud after being spotted partying and traveling during medical leave. Tracey Leong reports for NBC4 News at 11 p.m., May 20, 2025. Credit: NBC Los Angeles — https://www.nbclosangeles.com/ May 21, 2025 | JacobiJournal.com – A former Westminster police officer faces felony charges for allegedly committing insurance fraud and workers’ compensation fraud during her disability leave, the Orange County District Attorney’s Office announced. Nicole Brown, 39, from Riverside, faces nine felony counts for making false statements to receive compensation. She also faces six counts of fraudulent insurance claims. Prosecutors added a sentencing enhancement for aggravated white-collar crime involving over $100,000. Her stepfather, attorney Peter Gregory Schuman, 57, from Buena Park, also faces felony charges for filing fraudulent insurance claims and conspiring to commit illegal acts. Injury and Disability Insurance Fraud Allegations Brown injured her forehead while arresting a suspect in March 2022. An emergency room doctor treated her and cleared her to return to work. However, she later claimed a severe concussion and went on temporary disability leave, which is now at the center of the insurance fraud investigation initiated by the Orange County District Attorney’s Office. Evidence of Contradictory Activities During this time, Brown reportedly attended the Stagecoach Music Festival in April 2023 and was seen traveling and partying. Witnesses reported her dancing and drinking, contradicting her claims of severe symptoms. Investigators also found that Brown took part in two 5K races, snowboarded, skied, attended several soccer conferences, went to baseball games, played golf, and visited Disneyland. She also enrolled in online courses, despite complaining about screen sensitivity. Defense Statement Brown’s lawyer, Brian Gurwitz, said, “Ms. Brown suffered a debilitating head injury while on duty. She plans to vigorously challenge these allegations.” Legal Consequences and Next Steps The charges highlight increased scrutiny of workers’ compensation claims when claimants’ activities conflict with their reported injuries. Brown and Schuman face serious legal consequences if convicted. Stay updated with local crime and legal news from Orange County. FAQs: About Insurance Fraud and Disability Leave Abuse What qualifies as insurance fraud during disability leave? Insurance fraud occurs when an individual knowingly provides false or misleading information to receive disability benefits. In law enforcement or public service, this often includes exaggerating injuries or continuing to claim benefits after recovery. How do investigators detect insurance fraud in disability leave cases? Insurance fraud investigators often rely on surveillance footage, social media activity, medical record reviews, and witness testimony to identify discrepancies between a claimant’s reported injuries and actual behavior. In disability fraud cases, evidence of physical activity—like traveling or partying—while on leave can trigger prosecution. What are the legal consequences of committing insurance fraud while on leave? Penalties for insurance fraud may include felony charges, restitution orders, termination of employment, and loss of future benefits. In California, convicted individuals may also face imprisonment, fines, and professional disqualification. Subscribe to JacobiJournal.com for trusted updates on law enforcement misconduct, insurance fraud cases, and public integrity prosecutions across the U.S. 🔎 Read More from JacobiJournal.com:

California Vocational School CEO Faces 23 Felony Charges for Insurance Fraud

December 24, 2024 | JacobiJournal.com — California Vocational School CEO: Hazel Ortega, the CEO of one of California’s largest vocational return-to-work counselling centers, is facing 23 felony charges, including insurance fraud, theft, and forgery. Ortega, 53, who resides in La Habra, appeared in court this week after a California Department of Insurance (CDI) investigation uncovered evidence of her alleged fraudulent activities. The case has drawn significant attention from both state regulators and industry experts, as it underscores growing concerns about fraudulent practices within vocational rehabilitation services. Authorities noted that misuse of the Supplemental Job Displacement Benefit program not only defrauds insurers but also deprives injured workers of legitimate opportunities for retraining and reemployment. Legal analysts suggest the outcome of Ortega’s prosecution could influence future oversight and compliance standards for vocational counselling centers across California. Allegations of Forgery and Coercion The CDI launched its investigation following complaints from insurers who accused Ortega of defrauding at least four insurance companies. According to the allegations, Ortega forged documents on behalf of injured workers without their knowledge or consent. Her business, Ortega Counseling Center, reportedly referred injured workers to unapproved schools ineligible to receive voucher funds through California’s Supplemental Job Displacement Benefit (SJDB) program. The SJDB program provides financial assistance of $6,000 to $10,000 for injured workers seeking educational retraining or skill enhancement. To qualify, workers must use the funds at state-approved or accredited institutions. Ortega, however, pressured injured workers to attend unapproved schools and failed to inform them of alternative, eligible options. Detectives interviewed injured workers who had SJDB and vocational counselling invoices submitted by Ortega. These workers revealed they never saw or reviewed the forms Ortega submitted to insurers on their behalf. A History of Fraudulent Schemes This is not the first time Ortega has faced legal trouble. She was previously charged in Los Angeles County for her role in a separate insurance fraud scheme that reportedly netted nearly $1 million. Investigators allege that Ortega, along with other vocational counsellors, received approximately $500,000 in illegal kickbacks for referring injured workers to a fraudulent school in the Los Angeles area. The Los Angeles County District Attorney’s Office is currently prosecuting Ortega’s case. If convicted, she could face significant penalties, including restitution to defrauded insurers and potential prison time. Broader Implications for Injured Workers This case highlights critical vulnerabilities within programs designed to assist injured workers. Fraudulent activities like those alleged against Ortega undermine the integrity of vital benefits, leaving already vulnerable individuals without the support they need to return to work. For official details on ongoing fraud prosecutions, visit the California Department of Insurance press releases. FAQs: California Vocational School CEO What charges does the California Vocational School CEO face? The California Vocational School CEO, Hazel Ortega, faces 23 felony charges including insurance fraud, theft, and forgery. How did the California Vocational School CEO allegedly commit insurance fraud? Investigators allege the California Vocational School CEO forged documents and coerced injured workers into unapproved schools to misuse voucher funds. What role does the SJDB program play in the California Vocational School CEO case? The SJDB program provides retraining benefits, but prosecutors allege the California Vocational School CEO misdirected workers to ineligible schools. Has the California Vocational School CEO faced fraud charges before? Yes, the California Vocational School CEO was previously linked to another fraud scheme in Los Angeles County that involved nearly $1 million in losses. Is insurance fraud a felony in California? Yes, insurance fraud can be charged as a felony in California, particularly when it involves large financial losses, forged documents, or repeated fraudulent schemes, as in the case of Hazel Ortega. What are the consequences of insurance fraud? Consequences may include criminal charges, prison time, restitution to defrauded insurers, fines, and professional sanctions. Felony convictions, like those alleged against Ortega, can also carry long-term legal and financial repercussions. Is insurance fraud a major crime? Yes, insurance fraud is considered a major crime because it affects insurers, policyholders, and public trust. Large-scale or repeated fraud can lead to severe penalties and increased regulatory oversight. Stay ahead of the latest fraud and workers’ compensation cases—subscribe to JacobiJournal.com for breaking news, expert analysis, and legal insights. 🔎 Read More from JacobiJournal.com:

Yonkers Man Accused of Arson in $1.3 Million Insurance Fraud Scheme

December 20, 2024 | JacobiJournal.com — Yonkers Man Accused of Arson: A Yonkers resident, Majid Haddad, also known as Peter Haddad, faces serious charges. These include conspiracy, arson, and insurance fraud for allegedly hiring someone to burn down his home to collect over $1.3 million in insurance money. Westchester County District Attorney Miriam E. Rocah announced Haddad’s arrest and arraignment. His bail was set at $25,000 cash, $100,000 bond, or a $200,000 partially secured bond. Haddad is scheduled to appear in court again on January 10, 2025. Alleged Plot to Commit Arson Accused of Arson: Prosecutors claim that between February 20 and February 28, 2021, Haddad conspired with another individual to set his Odell Avenue home on fire. Haddad reportedly provided detailed instructions, including applying gasoline inside the house to start the fire. Days before the incident, he allegedly took the accomplice to a Lowe’s Home Improvement store to buy gasoline canisters and then to a gas station to fill them. Haddad is also accused of showing the accomplice how to ignite the fire and giving money for transportation after the act. On February 28, 2021, just before 1:00 a.m., the Yonkers Fire Department responded to the burning single-family home. The fire caused an explosion, collapsing the house, which was declared a total loss. Attempted Insurance Fraud After the fire, Haddad allegedly filed a claim with Adirondack Insurance Exchange, seeking at least $1.3 million for the destroyed property and its contents. However, an investigation by the Yonkers police and fire department’s investigation unit uncovered discrepancies. This led to the case being referred to the Westchester County District Attorney’s Office. The alleged actions in this insurance fraud scheme highlight the lengths some individuals may go to exploit coverage for personal gain. Investigators continue to examine the claim and supporting evidence to determine the full scope of the fraudulent activity and ensure accountability under the law. Legal Proceedings and Presumption of Innocence The charges against Haddad are allegations of insurance fraud and related crimes, and he remains presumed innocent until proven guilty in a court of law. Legal proceedings will involve thorough examination of evidence, witness testimony, and investigative findings to determine whether the claims of insurance fraud are substantiated. This presumption of innocence ensures that Haddad receives a fair trial while authorities pursue accountability for any fraudulent actions. Read the official release here. FAQs: Yonkers Arson Insurance Fraud What charges is Majid Haddad facing in the Yonkers arson case? Majid Haddad has been indicted on multiple felony charges, including conspiracy, arson, reckless endangerment, and insurance fraud, for allegedly orchestrating an arson to collect over $1.3 million in insurance money. How did Haddad allegedly plan the arson? Between February 20 and 28, 2021, Haddad allegedly hired an accomplice to set fire to his home, providing detailed instructions, purchasing gasoline canisters, and demonstrating how to ignite the fire. What was the outcome of the arson? On February 28, 2021, the Yonkers Fire Department responded to a fully engulfed single-family home on Odell Avenue. The fire caused an explosion and the house was declared a total loss. What is the status of Haddad’s legal proceedings? Haddad was arrested and arraigned on a six-count indictment. Bail was set at $25,000 cash, $100,000 bond, or $200,000 partially secured bond. He is scheduled to return to court on January 10, 2025. What are common signs of arson-related insurance fraud? Red flags include suspicious timing of the fire, prior insurance coverage changes, evidence of accelerants, unusual claim amounts, or inconsistencies in the claim. What penalties can someone face for committing arson-related insurance fraud? Penalties may include felony charges, prison time, fines, restitution to insurers, and a permanent criminal record. Stay informed about developments in this case and other legal news by subscribing to JacobiJournal.com. Our expert coverage keeps you updated on significant legal matters and their implications. 🔎 Read More from JacobiJournal.com: